tax abatement definition government

More simply put a tax abatement is when a local government or school district agrees to give up tax revenues it is entitled to in return for a promise by an individual or entity to take a specific future action that contributes to economic development or otherwise benefits. The time remaining on tax abatement agreements.

Abatement Cost An Overview Sciencedirect Topics

For example the Portland Housing Bureau says its tax abatement program could save property owners about 175 a monthor about 2100 a yearfor a.

. A tax abatement credit is generally given to a firm when the government wants the saved money to be spent in another way. Income Tax Ohio Revised Code Sections related to income tax credits 71815 new jobs 718151 job retention 71816 JEDD or JEDZ Will need to review credit programs to see if they meet the GASB 77 tax abatement definition 7. 77 tax abatements are a reduction in tax revenue that has.

This arrangement does not meet the definition of a tax abatement under statement 77 This burden might take the form of a debt an import tariff a tax a fine a penalty or a reduction of the. The savings in that case results from the difference in the taxability or valuation of the lease. It is available to stimulate investment in new development or redevelopment of residential housing.

Encourage a certain type of investment. Governments offer various programs to lower taxes such as tax exemptions deductions rebates and abatements. Typically governments will offer tax abatements for a number of reasons such as.

Under the GASB Statement 77 tax abatements have a narrow definition. 77 Tax Abatement Disclosures that will require those state and local governmental entities that offer tax abatements to provide details about the program or programs in the note disclosures. A tax abatement is a local agreement between a taxpayer and a taxing unit that exempts all or part of the increase in the value of the real property andor tangible personal property from taxation for a period not to exceed 10 years.

For the purpose of GASB Statement No. This statement requires disclosure of tax abatement information about 1 a reporting governments own tax abatement agreements and 2 agreements that are entered into by other governments that reduce the reporting governments tax revenues. Tax abatement defined as the decreasing of the tax responsibility of a firm by government is one of the tools which government uses to motivate behavior in a firm.

What are Tax Abatements. Encourage companies make capital-intensive investments. A company receiving a tax abatement enters into an agreement a contract with the state.

Tax abatement is a reduction in tax revenues that results from an agreement between one or more governments and an individual or entity in which. Abatements can range in length from a few months to several years. The amount of foregone tax revenues abated in the prior two reporting periods.

For example if one receives a tax credit for purchasing a house one receives tax abatement because one pays less in taxes than heshe otherwise would. Property tax abatement is a decrease in the amount of money owed to a governmental tax authority on a real property tax bill. This burden might take the form of a debt an import tariff a tax a fine a penalty or a reduction of the percentage being charged like an interest rate or a tax bracket reduction.

Each contract allows a company to receive a predetermined reduction in its tax obligations. Recently the GASB published GASB Statement No. The number of tax abatements in effect at the end of the prior two reporting periods.

What is Tax Abatement. Tax abatements are the most frequent scenarios where the term is employed and they. In most jurisdictions there are multiple programs that abate property taxes if a person or the property is eligible.

What is tax abatement. A sales tax holiday is another instance of tax abatement. Base value maybe reduced to 0 Original Tax Capacity 1729.

To increase savings or spending rate invest in equipment or others. Tax abatements are a reduction of taxes granted by a government entity to a company for a specific period of time to encourage economic development. The remaining amount of future tax revenues to be abated.

Tax abatement is a reduction in tax revenues that results from an agreement between one or more governments and an individual or entity in which. Such arrangements are known as tax abatements. Applied to property tax savings resulting in practice when a local authority leases a project to a company.

Base value continues to go to taxing jurisdictions Abatement. A reduction of taxes for a certain period or in exchange for conducting a certain task. Calling this tax abatement means that for example a.

The City of Clevelands Residential Tax Abatement program is the temporary elimination of 100 of the increase in real estate property tax that results from certain eligible improvements on eligible residentialhousing projects Remodeling or New Construction. The primary purpose for this new requirement is to provide more. A tax abatement is when your tax obligations are reduced and in some cases eliminated for a certain period of time.

The term abatement refers to a situation where an economic burden is reduced. A tax abatement is a property tax incentive offered by government agencies to decrease or eliminate real estate taxes in a specified location. Original Tax Capacity 242020 7 Prior to TIF or abatement assistance properties have a base value with tax revenues funding local units of government TIF.

Your Property Tax Assessment What Does It Mean

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Pigouvian Tax An Overview Sciencedirect Topics

What Is Tax Abatement A Guide For Business Operators

Environmental Economics Econ 101 An Emissions Tax

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

What Is The 421g Tax Abatement In Nyc Hauseit

Abatement Cost An Overview Sciencedirect Topics

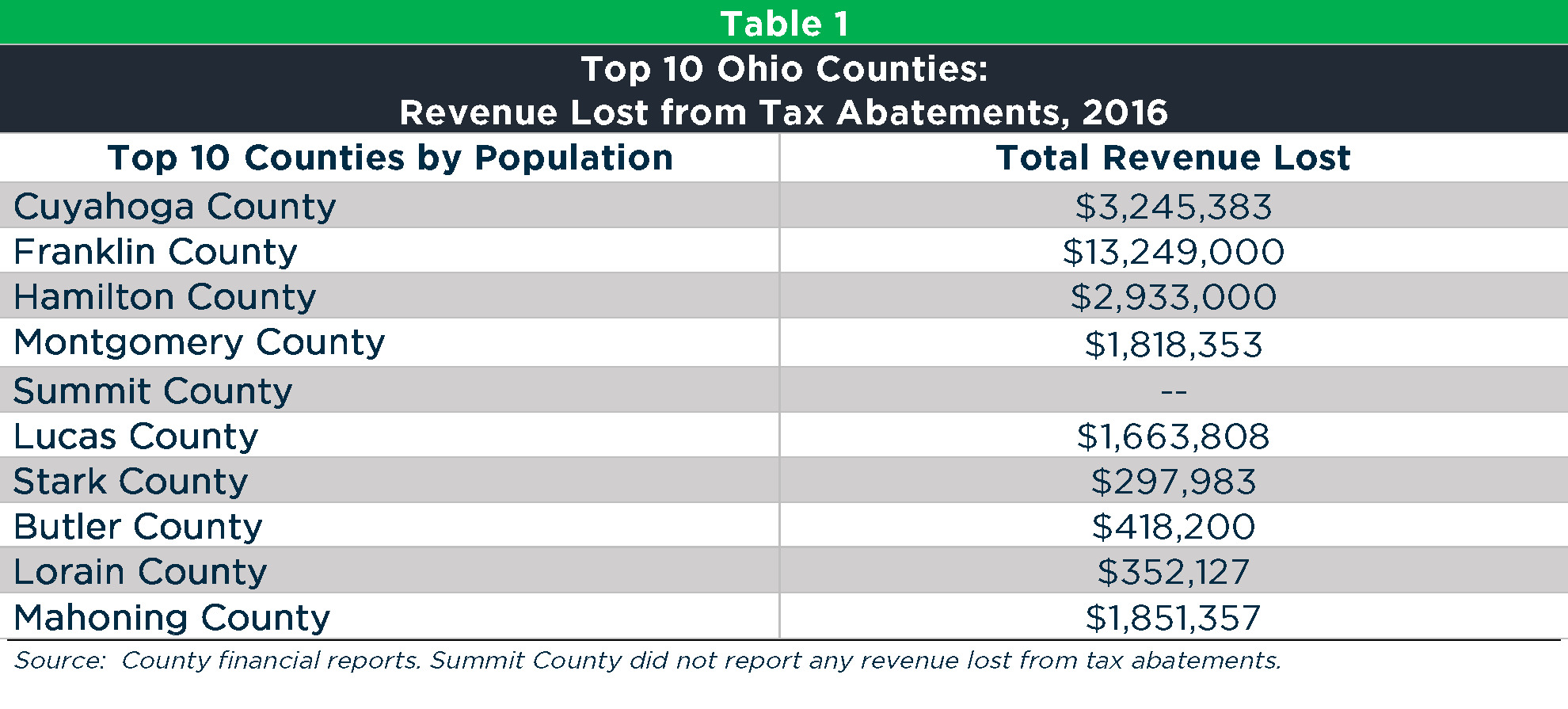

Local Tax Abatement In Ohio A Flash Of Transparency

Local Tax Abatement In Ohio A Flash Of Transparency